Trade Review: WDS Short Put

WDS stock rallied from $22.50 to $27.20 in a matter of days, before Trump ended the middle eastern dispute. Naturally, Oil and Oil stocks came crashing back down, but thats where I saw opportunity.

WDS has had a fall from grace and many headwinds over the recent years. Green energy, sustainable investing mandates and negative pressures on the climate polluting energies, Oil and Gas.

Thesis:

Iran and Israel declared war in June; details of that are for another day. The situation is that Oil suppy was in shock and we saw Brent Crude Futures rally 20% + in a number of days. As expected, Oil producers on the ASX, WDS and STO followed suit.

WDS stock rallied from $22.50 to $27.20 in a matter of days, before Trump ended the middle eastern dispute. Naturally, Oil and Oil stocks came crashing back down, but thats where I saw opportunity.

The day of the ceasefire, WDS went from $26 to $24, gapping down overnight.

Trade:

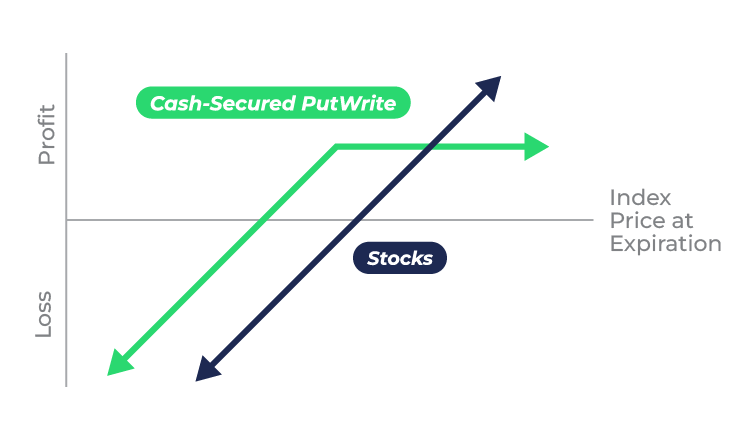

Implied volatility on WDS skyrockets and intraday passes 37% - which is fair enough considering the volatility in Oil and Middle-eastern tensions. This also creates opportunity. Here are the details

Date: 24th June 2025

Sold 17th July $23.51 Puts @$0.60

Why this trade?

WDS is a top quality ASX stock. Yes it's had its headwinds recently, however it still is a cash flow powerhouse and is on my watchlist to find trading opportunities.

Implied Volatility was extreme for WDS, with our reference volatility at 25% which identified good value for this trade. I was happy to take stock leading up to reporting season and dividend season, knowing the large dividends for WDS historically.

I wasn't expecting a rally higher after the news, as Oil would have to spike again (writing this post trade it would have made sense to sell a call option aswell, turing the short put into a strangle)

Break-even for this trade was $22.91 ($23.51 minus premium of $0.60), otherwise I keep the 60c if WDS stays above $23.51.

Fast Forward

Date: 7th July 2025

Buy-to-close 17th July Puts @$0.31

WDS price: $24

WDS price stayed at $24 for the following 2 weeks. Theta and Vega were in my favour destroying the premium in the Put options contracts and received about 50% on my total premium position.

Now, leading up to earnings season, there might be another opportunity to particiapte in WDS again, and look to collect the dividend.